-

Contact Us

-

General Inquiries/Service Requests:

- 888.313.6862

-

contactcenter@oncor.com

-

(Mon.-Fri., 8 a.m.-6 p.m. Central Time)

-

For Outages

- 888.313.4747

-

(24/7)

NEWS RELEASE

For additional information, contact:

Oncor Communications: 877.426.1616

Oncor Investor Relations: 214.486.6035

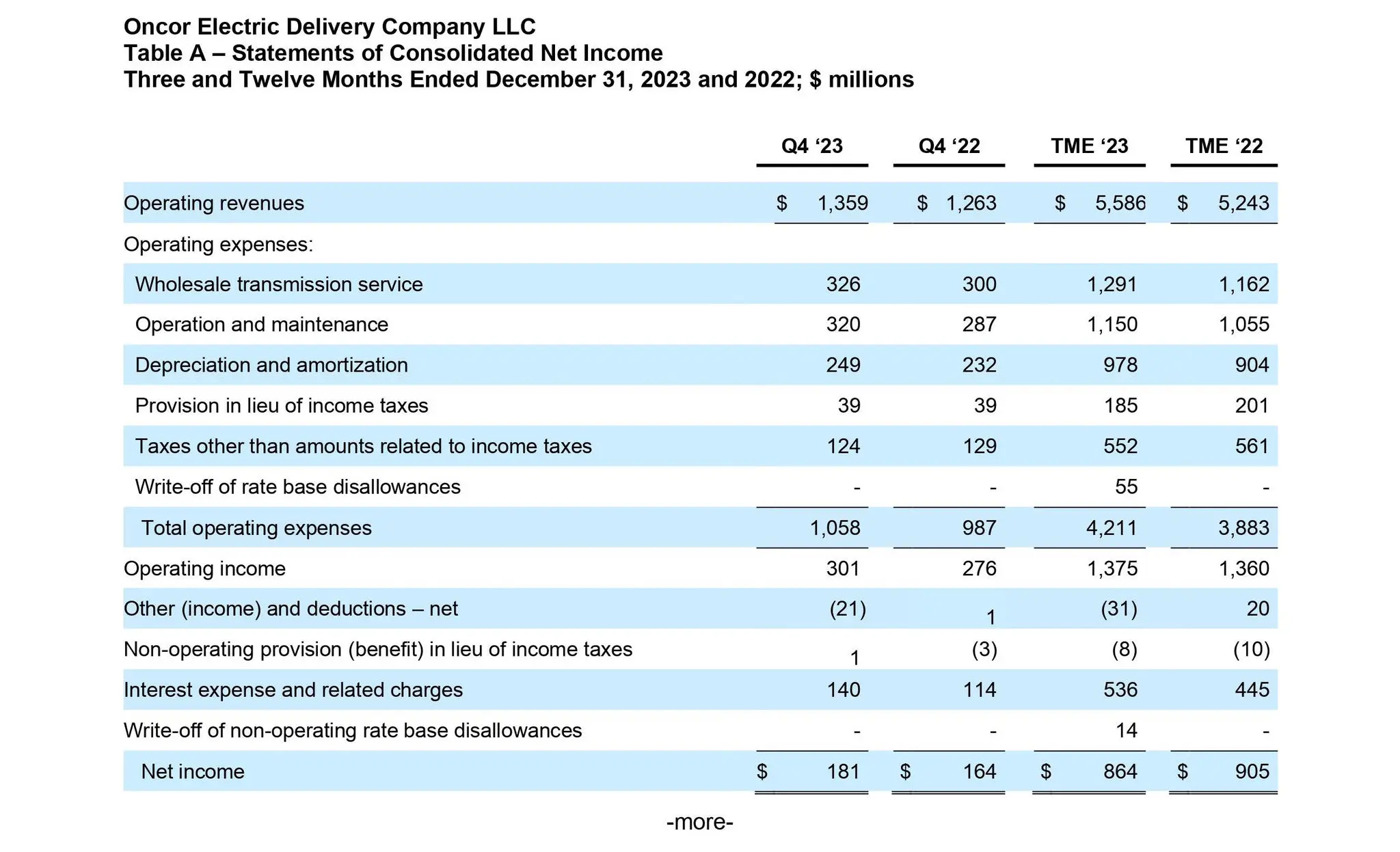

DALLAS (Feb. 27, 2024) — Oncor Electric Delivery Company LLC (“Oncor”) today reported twelve months ended December 31, 2023 net income of $864 million compared to twelve months ended December 31, 2022 net income of $905 million. This $41 million decrease was driven by higher costs associated with increases in invested capital (primarily borrowing costs and depreciation), higher operation and maintenance expense (primarily regulatory asset amortization and self-insurance reserve accrual recovery amounts in new base rates) and the write-off of rate base disallowances recorded in the first quarter of 2023 resulting from the Public Utility Commission of Texas’ (“PUCT”) final order in Oncor’s comprehensive base rate review in PUCT Docket No. 53601, partially offset by higher revenues primarily attributable to updated interim rates to reflect increases in invested capital, increases in transmission billing units as a result of certain increases in average Electric Reliability Council of Texas, Inc. (“ERCOT”) peak demand, the new base rates implemented May 1, 2023 following the PUCT’s final order in the base rate review and customer growth.

“Texas continues to secure major investments from world-class companies like Oncor to further bolster our critical infrastructure and the resiliency of the Texas electric grid,” said Governor Greg Abbott. “Oncor’s announcement today of a new $24.2 billion, five-year capital expenditures plan is a testament to Texas’ ongoing partnerships with companies to boost economic growth in our state in tandem with making our state’s electric grid more reliable and resilient for generations to come. As Texas’ population and economy continues to grow, I look forward to continuing to work with electricity providers like Oncor to help build an even bigger, better Texas for all.”

"As we reflect on our performance in the fourth quarter, and throughout 2023, it's clear that we're on an extraordinary and diverse growth path across our service area. This growth is driving our largest-ever capital plan, which will expand our investments in the ERCOT market and also help make our service more reliable, helping to better serve both new and existing customers,” said Oncor CEO Allen Nye.

“We also expect our first system resiliency plan filing later this year will lay out additional strategic investments in system hardening and modernization, enhanced vegetation management, wildfire mitigation, new technology and other resiliency measures over a three-year period. This will help us deliver a safer, smarter and more resilient electric grid for our state. As Texas continues to grow, it's crucial that we continue to build the electric infrastructure needed for the coming demand."

Oncor’s reported net income of $181 million in the three months ended December 31, 2023 compared favorably to net income of $164 million in the three months ended December 31, 2022. This $17 million increase was driven by higher revenues primarily attributable to updated interim rates to reflect increases in invested capital, the new base rates implemented May 1, 2023 and customer growth, partially offset by higher costs associated with increases in invested capital (primarily borrowing costs and depreciation), higher operation and maintenance expense (primarily regulatory asset amortization and self-insurance reserve accrual recovery amounts in new base rates) and lower customer consumption due to milder weather in the quarter.

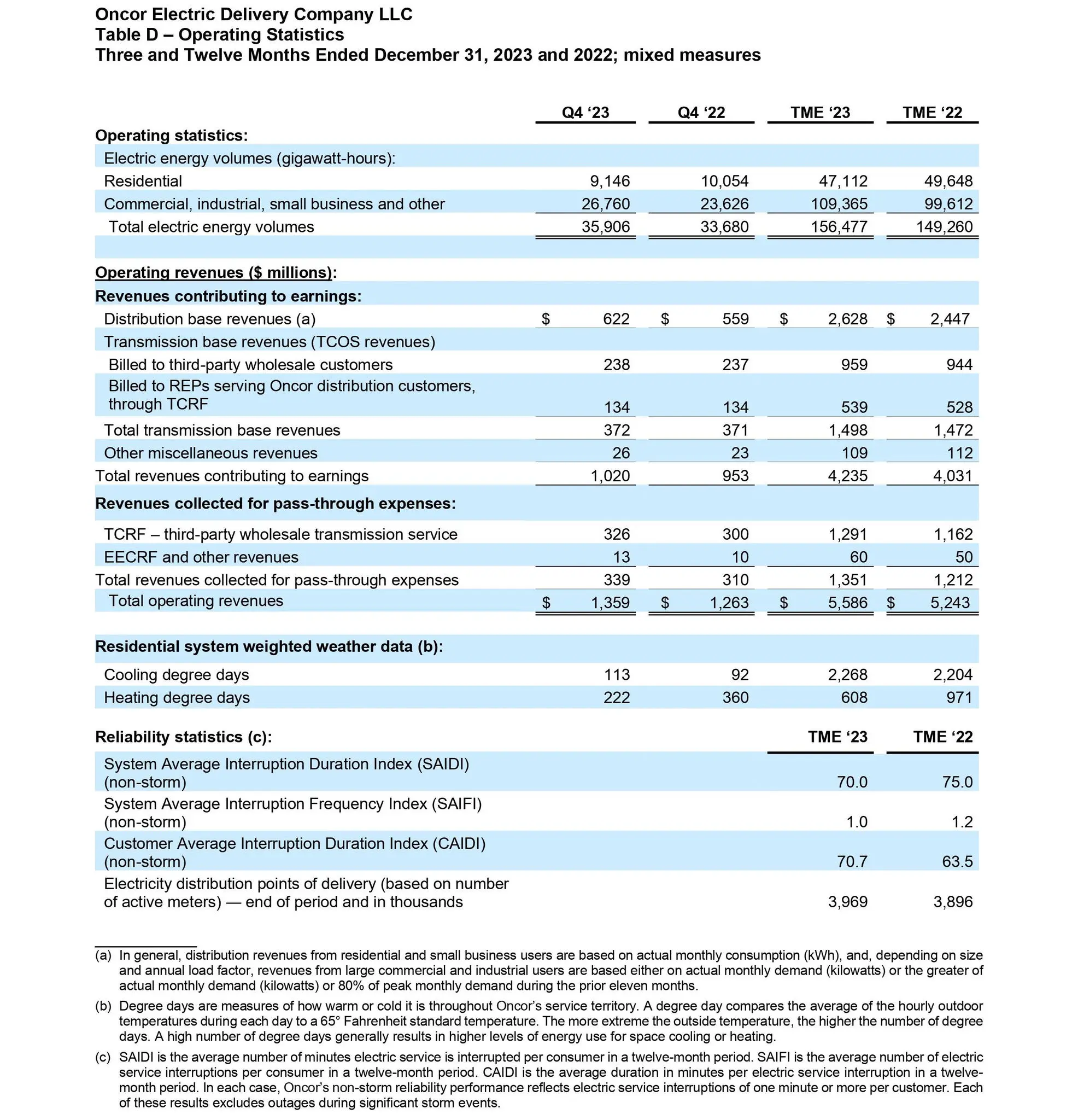

Oncor’s total distribution base revenues in the twelve months ended December 31, 2023 as compared to the twelve months ended December 31, 2022 increased 7.4% (9.2% increase on a weather-normalized basis). The change in Oncor’s total distribution base revenues in the twelve months ended December 31, 2023 included a 9.8% increase in distribution base revenues from residential customers (13.9% increase on a weather-normalized basis) and an 8.2% increase in distribution base revenues from large commercial and industrial (“LC&I”) customers. Oncor’s total distribution base revenues in the three months ended December 31, 2023 as compared to the three months ended December 31, 2022 increased 11.3% (15.2% increase on a weather-normalized basis). The change in Oncor’s total distribution base revenues in the fourth quarter of 2023 included a 15.5% increase in distribution base revenues from residential customers (24.0% increase on a weather-normalized basis) and a 13.5% increase in distribution base revenues from LC&I customers. Financial and operational results are provided in Tables A, B, C, and D below.

Growth Within Oncor’s Service Territory

Oncor experienced another strong year in 2023 with solid growth in premises and the construction of new transmission and distribution lines, as well as the setting of new year-end company records for transmission point-of-interconnection (“POI”) requests, all while remaining focused on safety and reliability.

Ongoing growth within Texas as a whole, and Oncor’s service territory in particular, continues to be a driver of distribution and transmission operational activity. Oncor increased its premise count by 73,000 in 2023 as compared to 64,000 in 2022. Additionally, Oncor placed approximately $1.6 billion of transmission projects into service in 2023. The continued growth across Oncor’s service territory resulted in the construction or upgrading of approximately 390 circuit miles of transmission lines and included 42 major substation projects and 34 major switching station projects, all being placed into service in 2023. The dynamic growth across Oncor’s service territory results in the continued opportunity to deploy capital to grow the Oncor system.

In 2023, Oncor set company records for annual active and new generation and retail transmission POI requests in queue. At December 31, 2023, Oncor had 763 active generation and retail transmission POI requests in queue, representing a 25% increase as compared to December 31, 2022. Of the 481 active generation POI requests in queue at December 31, 2023, 46% are solar, 42% are storage, 9% are wind and 3% are gas. Additionally, in 2023, Oncor entered 332 new generation and retail transmission POI requests into queue, representing a 19% increase as compared to 2022.

Oncor’s service territory continues to be vibrant, diverse and growing and has seen significant growth in commercial and industrial customers representing electric loads that are substantially larger than traditional commercial projects. Data center development continues to be robust across the Oncor service territory, including new sites that have the potential to support hyperscale computing and generative artificial intelligence services. These projects represent the potential for hundreds of megawatts of new electric load.

Capital Plan Update

Capital expenditures totaled approximately $3.8 billion in 2023. Oncor’s board of directors has approved a capital expenditures budget of approximately $4.5 billion for 2024. Oncor currently contemplates that its aggregate capital expenditures plan over the five-year period 2024-2028 will total approximately $24.2 billion, plus additional amounts attributable to capital expenditures associated with system resiliency plans (“SRPs”) pursuant to recently enacted Texas House Bill 2555 and related rules promulgated by the PUCT. SRPs are required to cover a minimum three-year period, and Oncor currently targets filing its first three-year SRP with the PUCT in the first half of 2024. Texas House Bill 2555 contemplates that the PUCT will review and approve, modify or deny a filed SRP within 180 days.

The increase in Oncor’s five-year capital plan compared to its prior five-year capital plan is due primarily to continued projected growth and expansion of its system, particularly on the transmission side of Oncor’s business as a result of the large volume of customer interconnection requests and generator interconnection requests that it has received through 2023 and expects to continue to receive. The increase is also partially driven by higher material costs due to tightening supply chains as well as increases in labor and contractor costs. In addition, Oncor anticipates that significant potential capital investment opportunities incremental to its five-year capital plan may be available as a result of continued growth in ERCOT, particularly on the transmission side of its business due to increased customer demand and additional distribution-related reliability and resiliency needs.

Operational Highlights

Oncor’s employees helped to ensure Texans had reliable power in 2023 as the state experienced significantly higher than normal summer temperatures in 2023. The ERCOT market saw 10 new peak demand records and reached a new all-time record peak demand of 85,508 megawatts on August 10, 2023, reflecting a 6.7% increase over the prior year’s peak. For the industry’s primary benchmark for reliability, System Average Interruption Duration Index (non-storm), Oncor’s customers experienced on average five fewer minutes of outage in 2023 compared to 2022 – an improvement of approximately 7%. The extreme heat experienced during the summer months of 2023 and extreme cold spell experienced in early January 2024, when ERCOT set a new record winter peak of 78,138 megawatts, demonstrate the continuing need for, and effectiveness of, system hardening and resiliency projects.

In the fourth quarter of 2023, Oncor completed its annual review of its wildfire mitigation plan, which contains focused initiatives in areas such as asset management, operational protocols, vegetation management, system protection technology and stakeholder engagement. Oncor’s wildfire mitigation strategy also includes a risk modeling tool, through which various risk factors are analyzed to inform long-term initiatives and real-time operational protocols, such as identification of wildfire mitigation zones. Oncor anticipates building on these efforts through new investments in wildfire mitigation in its inaugural SRP.

Oncor continued to be active in sustainability matters in 2023. In May, Oncor published its green bond spend report relating to its inaugural green bond issuance. In October, an independent third party environmental, social and governance (“ESG”) ratings company issued its annual ESG risk rating of Oncor, improving Oncor’s rating and ranking Oncor in the top 2 percent of electric utilities rated by that company at that time, reflecting lower ESG risk. Also, in 2023, Oncor was named as a 2023 Best Places to Work for Disability Inclusion by Disability:IN.

Liquidity

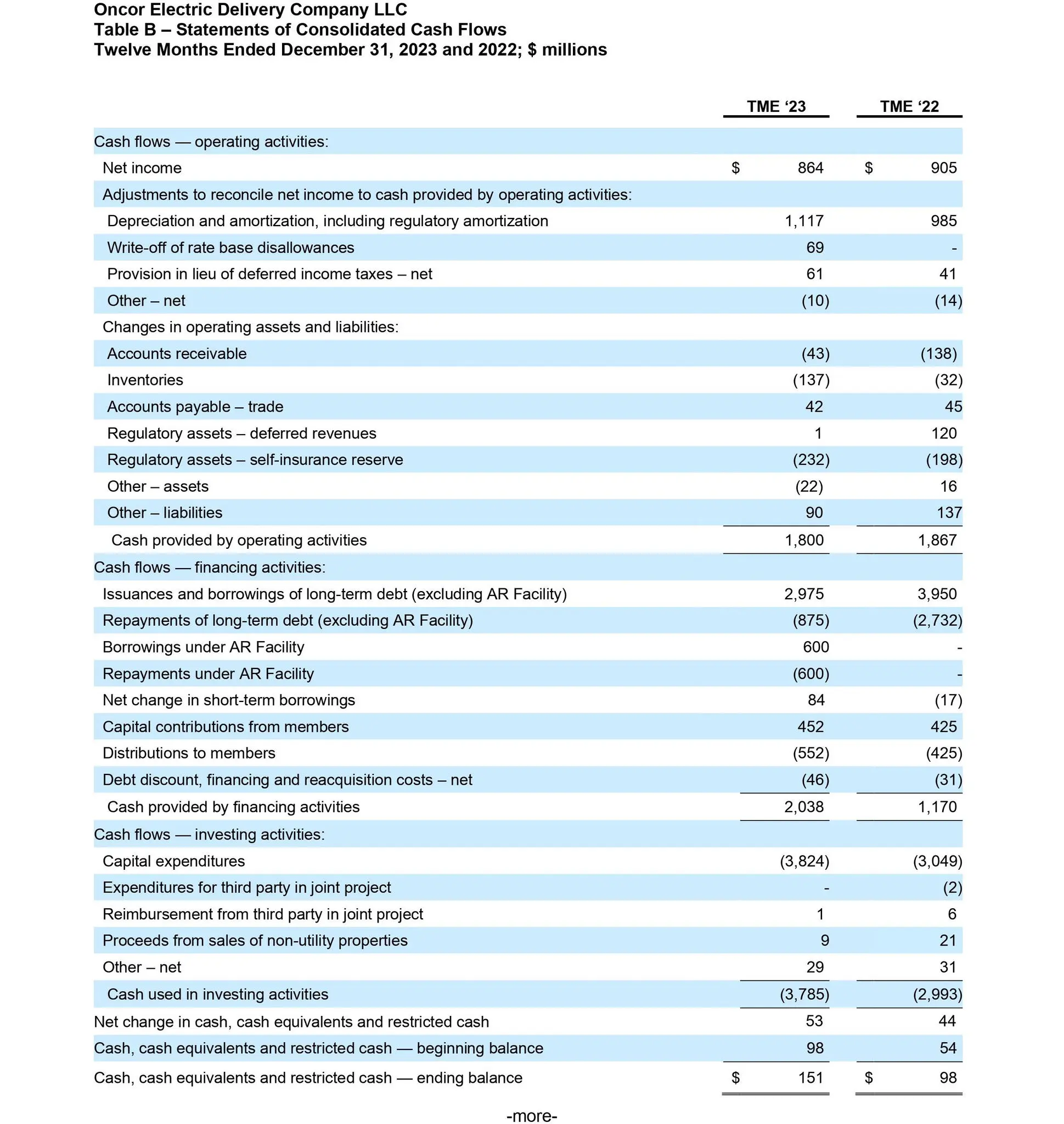

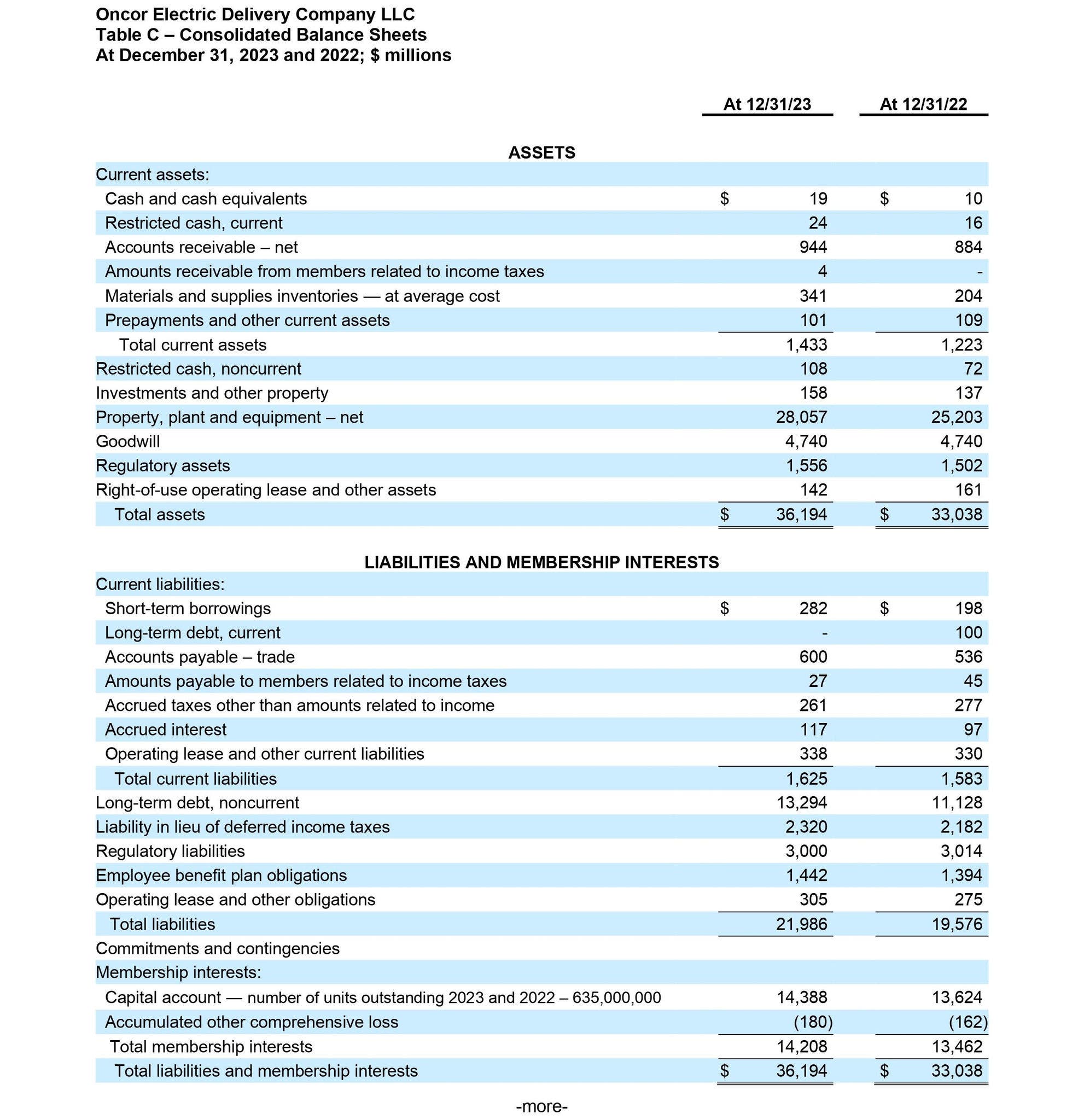

As of February 26, 2024, Oncor’s available liquidity, consisting of cash on hand and available borrowing capacity under its existing credit facilities, commercial paper program and accounts receivable facility (“AR Facility”), totaled $2.5 billion. Oncor expects cash flows from operations combined with long-term debt issuances and credit agreements as well as availability under its existing credit facilities, commercial paper program and AR Facility to be sufficient to fund current obligations, projected working capital requirements, maturities of long-term debt and capital expenditures for at least the next twelve months. Oncor currently expects to issue approximately $2.0 billion of long-term debt securities in 2024.

Sempra Internet Broadcast Today

Sempra (NYSE: SRE) (BMV: SRE) will broadcast a live discussion of its earnings results over the Internet today at 12 p.m. ET, which will include discussion of 2023 results and other information relating to Oncor. Oncor Chief Executive Allen Nye will also participate in the broadcast. Access to the broadcast is available by logging onto the Investors section of Sempra’s website, sempra.com/investors. Prior to the conference call, an accompanying slide presentation will be posted on sempra.com/investors. For those unable to participate in the live webcast, it will be available on replay a few hours after its conclusion at sempra.com/investors.

Annual Report on Form 10-K

Oncor’s Annual Report on Form 10-K for the year ended December 31, 2023 will be filed with the U.S. Securities and Exchange Commission after Sempra’s conference call and once filed, will be available on Oncor’s website, oncor.com. The annual financial statements of Oncor Electric Delivery Holdings Company LLC (which holds 80.25% of Oncor’s outstanding equity interests and is indirectly wholly owned by Sempra) for the year ended December 31, 2023 will be included as an exhibit to Sempra’s Annual Report on Form 10-K for the year ended December 31, 2023.

Headquartered in Dallas, Oncor Electric Delivery Company LLC is a regulated electricity transmission and distribution business that uses superior asset management skills to provide reliable electricity delivery to consumers. Oncor (together with its subsidiaries) operates the largest transmission and distribution system in Texas, delivering electricity to nearly 4 million homes and businesses and operating more than 143,000 circuit miles of transmission and distribution lines in Texas. While Oncor is owned by two investors (indirect majority owner, Sempra, and minority owner, Texas Transmission Investment LLC), Oncor is managed by its Board of Directors, which is comprised of a majority of disinterested directors.

***

Forward-Looking Statements

This news release contains forward-looking statements relating to Oncor within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. All statements, other than statements of historical facts, that are included in this news release, as well as statements made in presentations, in response to questions or otherwise, that address activities, events or developments that Oncor expects or anticipates to occur in the future, including such matters as projections, capital allocation, future capital expenditures, business strategy, competitive strengths, goals, future acquisitions or dispositions, development or operation of facilities, market and industry developments and the growth of Oncor’s business and operations (often, but not always, through the use of words or phrases such as “intends,” “plans,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “forecast,” “should,” “projection,” “target,” “goal,” “objective” and “outlook”), are forward-looking statements. Although Oncor believes that in making any such forward-looking statement its expectations are based on reasonable assumptions, any such forward-looking statement involves risks, uncertainties and assumptions. Factors that could cause Oncor’s actual results to differ materially from those projected in such forward-looking statements include: legislation, governmental policies and orders, and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; weather conditions and other natural phenomena, including any weather impacts due to climate change; acts of sabotage, wars, terrorist activities, cybersecurity attacks, wildfires, fires, explosions, hazards customary to the industry, or other emergency events and the possibility that Oncor may not have adequate insurance to cover losses or third-party liabilities related to any such event; actions by credit rating agencies; health epidemics and pandemics, including their impact on Oncor’s business and the economy in general; interrupted or degraded service on key technology platforms, facilities failures, or equipment interruptions; economic conditions, including the impact of a recessionary environment, inflation, supply chain disruptions, competition for goods and services, service provider availability, and labor availability and cost; unanticipated population growth or decline, or changes in market demand and demographic patterns, particularly in the ERCOT region; ERCOT grid needs and ERCOT market conditions, including insufficient electric capacity within ERCOT or disruptions at power generation facilities that supply power within ERCOT; changes in business strategy, development plans or vendor relationships; changes in interest rates or rates of inflation; significant changes in operating expenses, liquidity needs and/or capital expenditures; inability of various counterparties to meet their financial and other obligations to Oncor, including failure of counterparties to timely perform under agreements; general industry and ERCOT trends; significant decreases in demand or consumption of electricity delivered by Oncor, including as a result of increased consumer use of third-party distributed energy resources or other technologies; changes in technology used by and services offered by Oncor; significant changes in Oncor’s relationship with its employees, including the availability of qualified personnel, and the potential adverse effects if labor disputes or grievances were to occur; changes in assumptions used to estimate costs of providing employee benefits, including pension and retiree benefits, and future funding requirements related thereto; significant changes in accounting policies or critical accounting estimates material to Oncor; commercial bank and financial market conditions, macroeconomic conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds and the potential impact of any disruptions in U.S. capital and credit markets; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; financial and other restrictions under Oncor’s debt agreements; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; and Oncor’s ability to effectively execute its operational strategy.

Further discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor with the U.S. Securities and Exchange Commission. Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. Any forward-looking statement speaks only as of the date on which it is made, and, except as may be required by law, Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for Oncor to predict all of them; nor can it assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. As such, you should not unduly rely on such forward-looking statements.